Executive Summary

Authors Neil Howe and William Strauss published a book called The Fourth Turning in 1997, introducing their theory about the seasonality of American history over more than 500 years.

They propose that four seasons, or Turnings, play out in society, much like in nature, however, they do so over the course of a long human life (80-100 years). As a result, each season ranges from 20-25 years rather than a few months.

In the original book, they described the environment of the late 1990s as the Fall season, or a period of unraveling in the US that would soon lead to Winter, or a Crisis period, which they refer to as a Fourth Turning.

The Fourth Turning is Here, the recently released sequel to the original, revisits the theory and applies it to what author Neil Howe has coined the “Millennial Crisis,” in which we currently find ourselves.

In this note, we will explore the theory and its potential implications for our society. Additionally, we will discuss how we can prepare for crisis periods as investors.

“The past is never dead. It’s not even past.”

William Faulkner (Requiem for a Nun)

In their original work, The Fourth Turning, Neil Howe and William Strauss put forth their theory about the seasonality of American history. The idea is based on their extensive research into historical events, cultural trends, and generational attitudes through time. The book asserts that this theory can help us understand the past, present, and future of American history and society.

The research behind the theory began in the 15th century. The authors found that this seasonality of history did not exist in the ancient world. Howe states, “Paradoxically, it was roused and awakened by the very birth of modernity – which, in the societies of Western Europe, happened nearly six centuries ago.”1Source: The Fourth Turning is Here As societies moved from primarily agrarian life, one tied closely to the land and the seasons, to a more urban and industrial existence, linear time replaced cyclical time and seasonality. As if to remind humanity of the power of the natural world, it was at this point that the authors began to see the seasons of history form in Western Europe. These seasons have continued to strengthen alongside modernity ever since.

Looking back over 500 years, they began to see a recurring pattern; distinct seasons were apparent, each about the length of a generation (20-25 years) and these four seasons roughly equated to the length of a long human life. As a result, a long-lived elder typically experiences all four seasons in his or her lifetime.

The seasons themselves, Spring (First Turning), Summer, Fall, and Winter (Fourth Turning), play out much as they do in the natural world. Spring is a time of renewal when civic order and strengthening institutions are in vogue. Meanwhile, Winter marks the most challenging time, as old institutions break down and survival itself is in doubt.

The author summarizes the seasons, or turnings, as follows (most recent example included, as well):2Source: The Fourth Turning is Here

- The First Turning is a High, an upbeat era of strengthening institutions and weakening individualism, when a new civic order implants and an old values regime decays. (Post WWII until Kennedy assassination, 1946-1964)

- The Second Turning is an Awakening, a passionate era of spiritual upheaval, when the civic order comes under attack from a new values regime. (Kennedy assassination until Ronald Reagan’s New Day speech, 1964-1984)

- The Third Turning is an Unraveling, a downcast era of strengthening of individualism and weakening of institutions, when the old civic order decays and the new values regime implants. (New Day speech until Great Financial Crisis, 1984-2008)

- The Fourth Turning is a Crisis, a decisive era of secular upheaval, when the values regime propels the replacement of the old civic order with a new one. (Great Financial Crisis of 2008 until present, 2008-?)

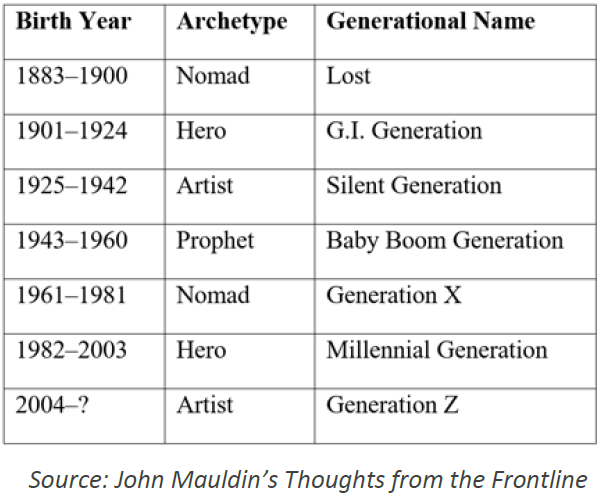

The theory also posits that the seasonality of society brings about different generational archetypes that follow a recurring pattern, created by generations experiencing different seasons in different phases of life (see chart at right). A Prophet generation grows up during an Awakening period, a Nomad during an Unraveling, a Hero during the beginning of the Crisis, and an Artist as the Crisis ends and the subsequent High begins. As a result, each generation enters the Fourth Turning, or Crisis period, at different phases of their life. The Prophets enter as visionary elders, the Nomads as pragmatic mid-lifers, the Heroes as team-building young adults, and the Artists as sensitive children.

From this premise, the authors take readers back through time to illustrate how the seasonality of time and cycles of generations have played out since the 15th century. In addition, they describe the prior Fourth Turnings of American history. Those include the Revolutionary War, the Civil War, and the Great Depression/WWII periods.

The original book, The Fourth Turning, ends in a way that Game of Thrones fans will find familiar – Winter is Coming. The book was published in 1997, midway through what the authors considered an Unraveling period or Fall season. Much like the Game of Thrones series, Howe and Strauss suggested that the coming of Winter is inevitable and it will serve as a societal rite of passage.

Moreover, the authors suggest that Winter is necessary as it resets society and sets the stage for the following Spring season, a time of previously unimaginable growth and community building. In a way, the only thing worse than a Crisis is that it never comes, and we remain in an Unraveling period indefinitely.

The Fourth Turning is Here

“History is seasonal, and winter is here.”

Neil Howe (The Fourth Turning is Here)

The sequel, The Fourth Turning is Here, was published a few months ago. Author Neil Howe (William Strauss has unfortunately passed) claims we are now in the middle of what he has coined as the Millennial Crisis, which began with the Great Financial Crisis of 2008. This Fourth Turning comes at a time in which the seasons of society are becoming more synchronized globally. While seasonal patterns were regional early on, the last two Fourth Turnings, the revolutionary period of the late 1800s and then WWII, affected large parts of the globe simultaneously, serving to synchronize the global calendar.

Howe points to the following markers of the Fourth Turning we’re experiencing globally:

- Citizens have lost faith in institutions.

- Partisan politics are at extreme levels, making each election “the most important of our lifetimes.”3To read more on this topic, see our previous note, “Knife Fight”

- Wealth disparity has risen, leading to higher levels of populism.

- After decades of globalization, deglobalization and nationalism are gathering steam.4To read more on this topic, see our previous note, “Coordination to Competition”

- The number of autocracies has been expanding worldwide.

- Emerging bifurcation between the US-led West and the anti-West axis (China, Russia, Iran, and North Korea).

- Russia, one of the anti-West axis, launched the largest land war in Europe since WWII. Conflict has also recently erupted between Israel and Hamas, destabilizing the Middle East.

In addition to the global calendar becoming more synchronized, technological leaps make each Fourth Turning potentially more dangerous than the previous one. Advancements in traditional weapons, along with the exponential growth of the internet, machine learning, artificial intelligence, and synthetic biology, may change the nature of competition and conflict in the coming years.

It is important to note that while the theory suggests that this seasonal pattern is predictable, the specific events that define those Turnings are not predictable. The authors suggest that we are in Winter currently, but we cannot foresee the exact form that the crisis will take nor know precisely when it will arrive (the author estimates the early 2030s).

Lessons from History

The original book and the recently published sequel provide detailed accounts of how previous Fourth Turnings unfolded. In general, societies were galvanized to overcome the crisis, and new civil visions and institutions emerged afterward. Individualism took a backseat to the common good as everyone pitched in to overcome the existential threat, whatever form it took (see WWII’s Rosie the Riveter at right5Source: https://americanhistory.si.edu/collections/search/object/nmah_538122). Additionally, each generation played its unique role in surviving Winter and in building the foundation for the next Spring season.

However, it is more challenging to explore specific investment lessons from past Fourth Turnings, given the relatively short history of modern investment markets compared to these long societal cycles. In addition, the authors suggest that we’ve only experienced five Fourth Turning periods since this pattern emerged, a tiny sample size from a statistical perspective. As a result, each crisis period is essentially uncharted territory. As a result, making specific investment recommendations is not advisable.

“In preparing for battle I have always found that plans are useless, but planning is indispensable.”

President and former General Dwight D. Eisenhower

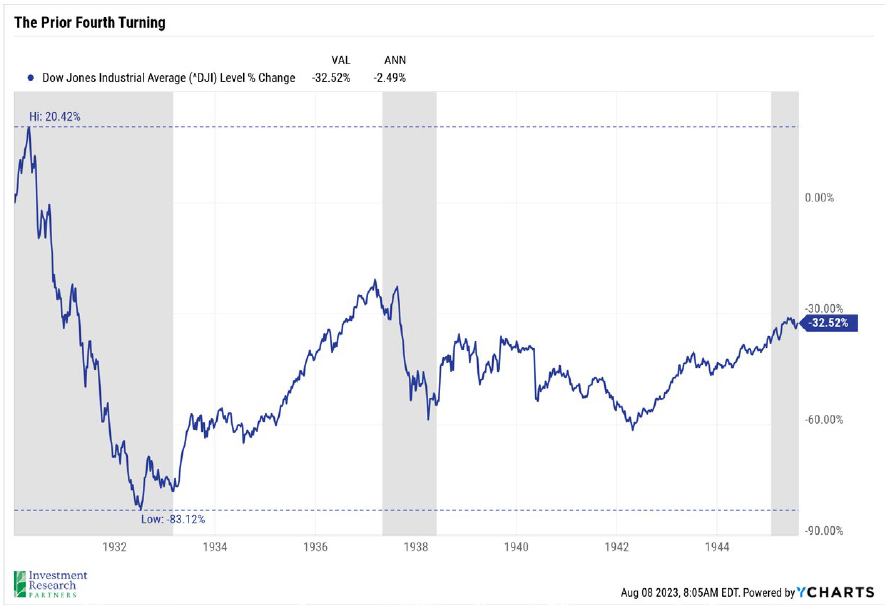

While making specific recommendations about tumultuous times in the future may not be advisable, there are broad lessons to learn by looking back at history. For example, we can look at how equity markets behaved during the last Fourth Turning, the Great Depression/WWII period. In addition, several recessions and market shocks have occurred in the past few decades that we can consider as mini-crisis periods. No one of these prior periods will perfectly align with what future crises will look like. However, the collective wisdom gained may help us prepare for the next calamity whenever it comes.

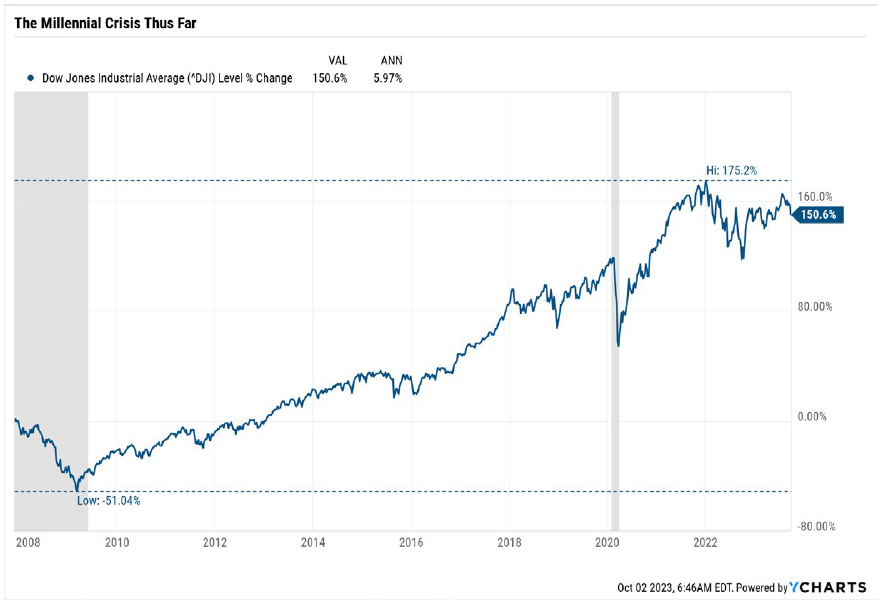

1. Expect Uncertainty – Greek philosopher Heraclitus, is credited with saying, “The only constant in life is change.” The sentiment also holds true for investing, especially when times get tough. Crisis periods are hard to time and their duration is equally difficult to pin down. Consider the comparison between the Great Depression/WWII Fourth Turning and the current Millennial Crisis thus far (see charts at right). Both began with a financial meltdown, the Great Depression and the Great Financial Crisis, respectively. In each case, stocks fell sharply at the onset and then began to recover. However, additional recessions and volatility continued until WWII ended, leaving the Dow Jones Industrial Average (DJIA) more than 30 percent lower than it was at the beginning of 1930.

By contrast, the Millennial Crisis has played out quite differently. Beginning in 2009, the DJIA rally that started after the Great Financial Crisis lasted a full decade. Even after the Covid-19 pandemic in 2020 and the challenging market environment in 2022, the index is up approximately 200 percent since the bottom in 2009. Investors should remember that investing, especially in risk assets like stocks, can often be a volatile and unpredictable experience. That brings us to our next lesson…

2. Maintain Liquidity & Avoid Excessive Leverage – Realizing that investing in risk assets can be a bumpy ride, we believe that maintaining an adequate emergency fund can help investors ride out the ups and downs of the market. For most people, an impressive long-term investment return doesn’t matter much if they can’t pay their monthly mortgage or rent payment. While “adequate” differs for every investor, having access to liquid and low-risk assets can help you avoid selling risk assets when they are down to fund near-term needs, allowing them time to recover.

Likewise, avoiding excessive leverage may also help you survive a crisis. It is important to note that leverage or borrowing isn’t necessarily a bad thing. For example, many of us would not have been able to buy our first home or car without taking out a loan from the bank. However, it is essential to realize that leverage can amplify both positive and negative returns. Many investors, individuals and professionals alike, have found themselves on the wrong end of excessive borrowing when the market turned south.

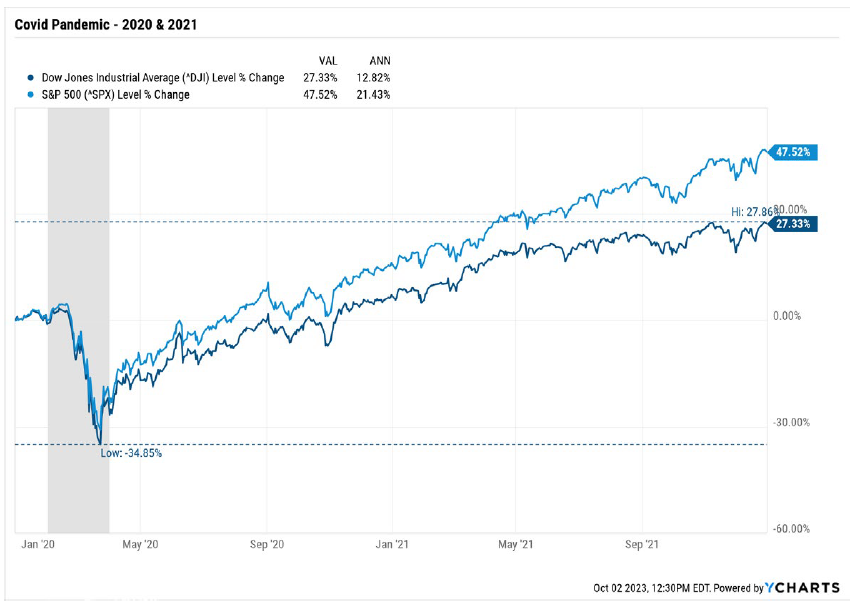

3. Be Adaptive Yet Disciplined – A crisis naturally induces panic, regardless of whether the cause is a war, a deep recession, or a pandemic. Remember the Spring of 2020 and the uncertainty that existed as the Covid-19 pandemic spread. People were scared, and rightly so. Stock markets quickly dropped about 30 percent as the news looked bleak. However, investors who sold and went to cash during the worst of the sell-off missed out on what would ultimately be an excellent two-year period for stocks (see right, the DJIA was up over 27 percent, and the S&P 500 index was up more than 47 percent over 2020 and 2021). Approval of new mRNA vaccines and significant fiscal and monetary support helped markets bounce back quickly.

The lesson is that circumstances can change quickly, and a market rally is just as hard to predict as a crash. As a result, striking a balance between being adaptable to the evolving circumstances yet disciplined in maintaining a diversified asset allocation can help you both weather the storm and participate in the rebound afterward.

4. Mind Your Time Horizon – Morgan Housel wrote, “Most financial debates are people with different time horizons talking over each other.”6Source: Some Things I Think · Collab Fund To a recent college graduate who has just started her first job, losing 30 percent in a year isn’t ideal, but it is far from disastrous given that retirement is still four or five decades off. However, losing 30 percent of your nest egg a year after retirement could be catastrophic for a retiree relying on that money for living expenses.

Remember that if you lose 30 percent of your portfolio, you need a return of about 43 percent to get back to even. As a result, avoiding large losses when you are in or approaching retirement should be a bigger priority than maximizing returns for most investors.

Summary

The seasonal theory of modern society proposed in The Fourth Turning and its sequel is provocative and compelling, but it is important to remember that it is just a theory. Regardless of whether it holds in the future, looking to the past to see how seemingly inconceivable events consistently emerge to challenge each generation can be instructive. In reference to the quote above from Dwight Eisenhower, the act of planning can be useful even if the plan itself doesn’t play out as anticipated.

Chaotic periods will come and go, and they will impact global markets. We now find ourselves in a precarious environment. We are experiencing a polarizing political environment in this country, two regional wars are being fought globally (Ukraine/Russia and Israel/Hamas), and we see increased competition between the US-led West and China. Whether the next crisis is five days or five years away, the time to plan for a storm is before dark clouds start rolling in.

Lastly, it is important to remember that as Neil Howe writes about the Crisis to come, he remains unflinchingly optimistic. If we are indeed in Winter, he reminds us that Spring will be here soon, bringing a renewed sense of community and shared purpose. As fiduciaries, we will continue to lean into opportunities and out of risks as they emerge and evolve over time. As always, please do not hesitate to contact us to schedule a time to discuss your specific situation.

References

- 1Source: The Fourth Turning is Here

- 2Source: The Fourth Turning is Here

- 3To read more on this topic, see our previous note, “Knife Fight”

- 4To read more on this topic, see our previous note, “Coordination to Competition”

- 5

- 6