Executive Summary

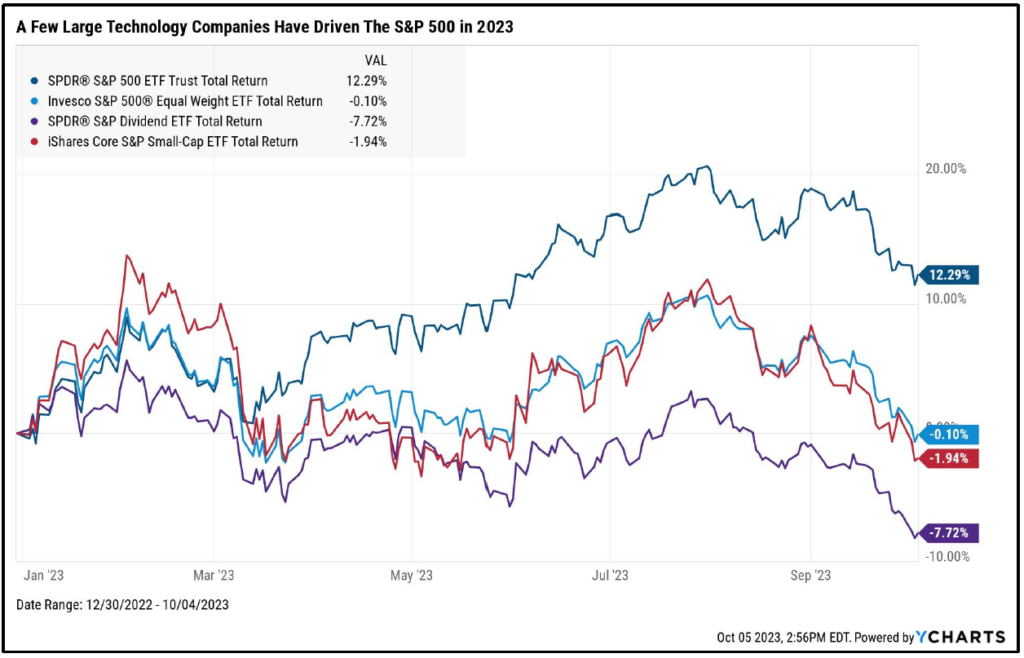

The Biggest Companies Dominate 2023: Top companies like Apple and Microsoft make up a big part of the stock market and have driven returns this year while most others are flat or down.

Interest Rates Are Up: Higher interest rates make it costlier to borrow money. This is affecting businesses and people are spending less. It is good news for savers and investors who can now earn higher yields.

Better Opportunities Today: Despite challenges, there are opportunities to invest in companies at good prices. Smaller companies, in particular, seem promising today in anticipation of the next economic uptrend.

Jobs Market is Strong: Few people are without jobs, and salaries are rising faster than daily expenses for most people. This is a good thing.

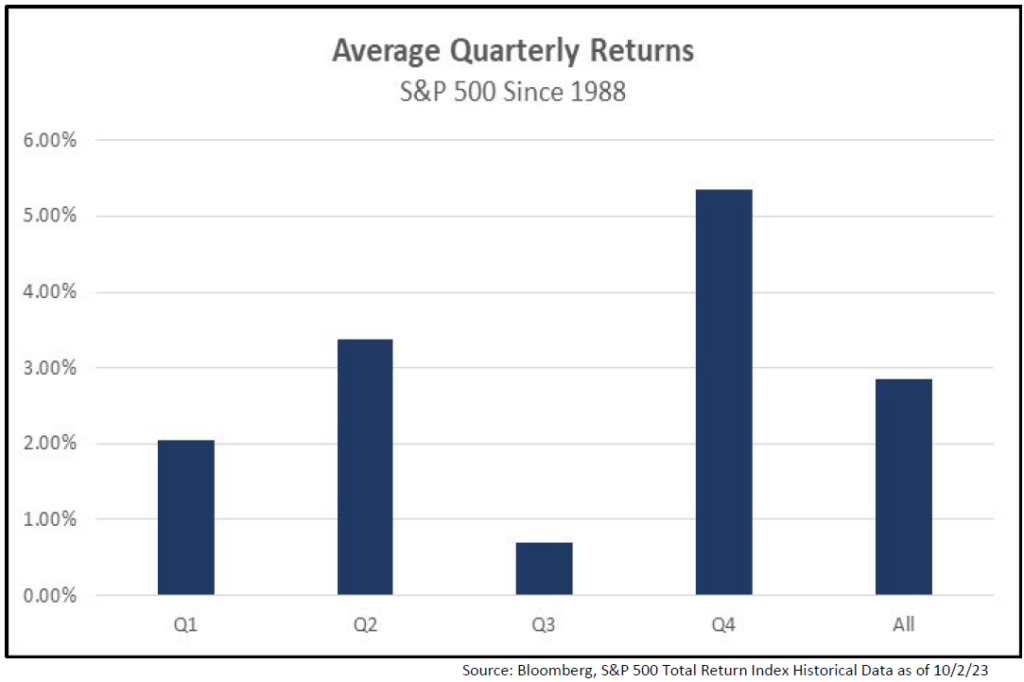

Higher Near-Term Uncertainty Possible: The stock market could experience continued turbulence through the rest of the year, but we may be near a relief rally as interest rates stabilize.

One Chart You Need: Market Concentration

The top ten holdings of the S&P 500 index now represent 32% of the index, greater than the concentration witnessed during the height of the “tech bubble” in the late 1990s (27%).1JP Morgan Guide to the Markets as of September 30, 2023 Outside of companies like Apple, Microsoft, Amazon, Alphabet, and Nvidia, many parts of the market are flat or negative in 2023.

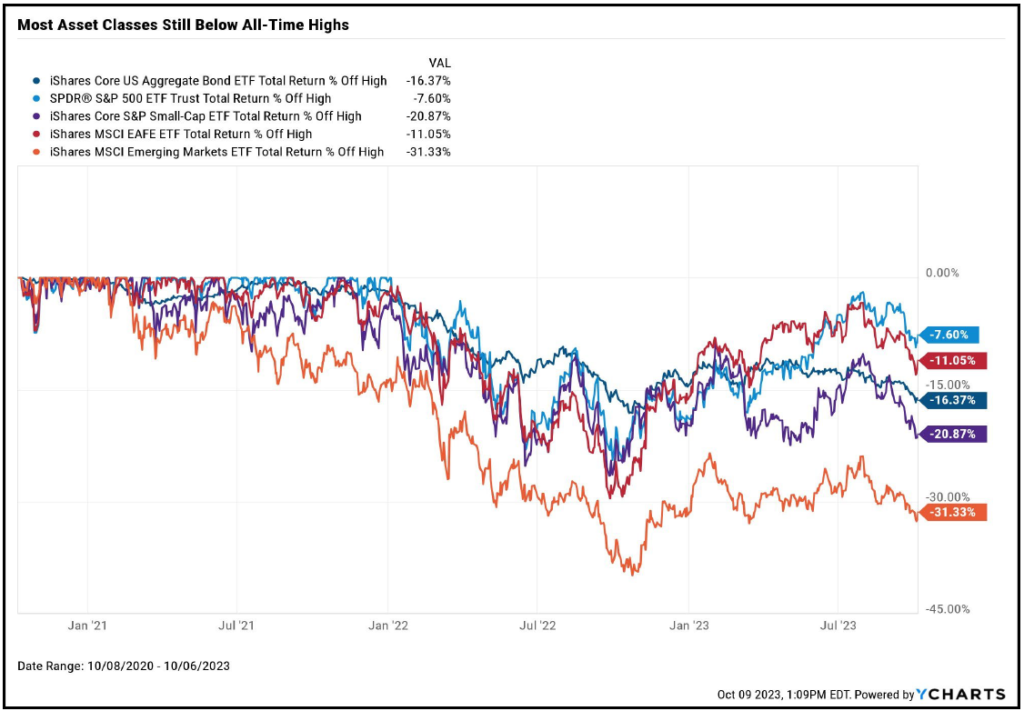

Stocks and bonds declined in September as expectations for interest rates to remain “higher for longer” increased. After a very robust economic recovery following the pandemic, the US Federal Reserve embarked on its most aggressive interest rate hiking campaign in more than 40 years in an effort to control inflation and smooth economic volatility. It has now been almost two years since most major asset classes have reached all-time highs, and investors are rightfully feeling fatigued. Even the technology companies that have led the way in 2023 still haven’t reached a new high watermark after a terrible 2022. The good news is that many businesses have grown during that time, interest rates are higher, dividend yields are higher, and the potential for compelling returns in the years to come seems the best it’s been in years.

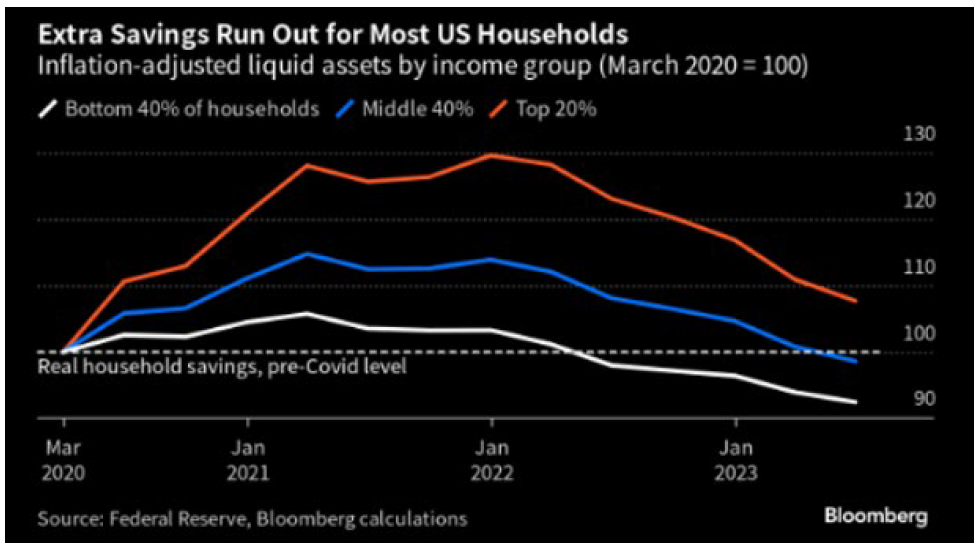

We are seeing many signs that the Fed’s approach is having its desired result of slowing economic activity and inflation. We hear across many companies and industries that projects are being slowed or reconsidered because they make less financial sense in a higher interest rate environment. Higher mortgage rates have slowed home building activity, US manufacturing activity has been in decline since late 2022, and US households have begun to slow their spending as higher costs have eaten into savings and sentiment. For better or worse, the inflation “medicine” is working.

That all sounds pretty bad, right? It’s supposed to be bad; the Fed wants a period of slowdown and consolidation following the very robust economic expansion after the pandemic. The Fed follows a dual mandate of promoting maximum employment and price stability. Another way to think about the Fed’s role in the economy is to help promote economic stability; to mitigate the impact of boom and bust cycles, to smooth the ride to allow businesses and households to plan and have reasonable expectations about the future trajectory of the economy, prices, and their potential to find gainful employment.

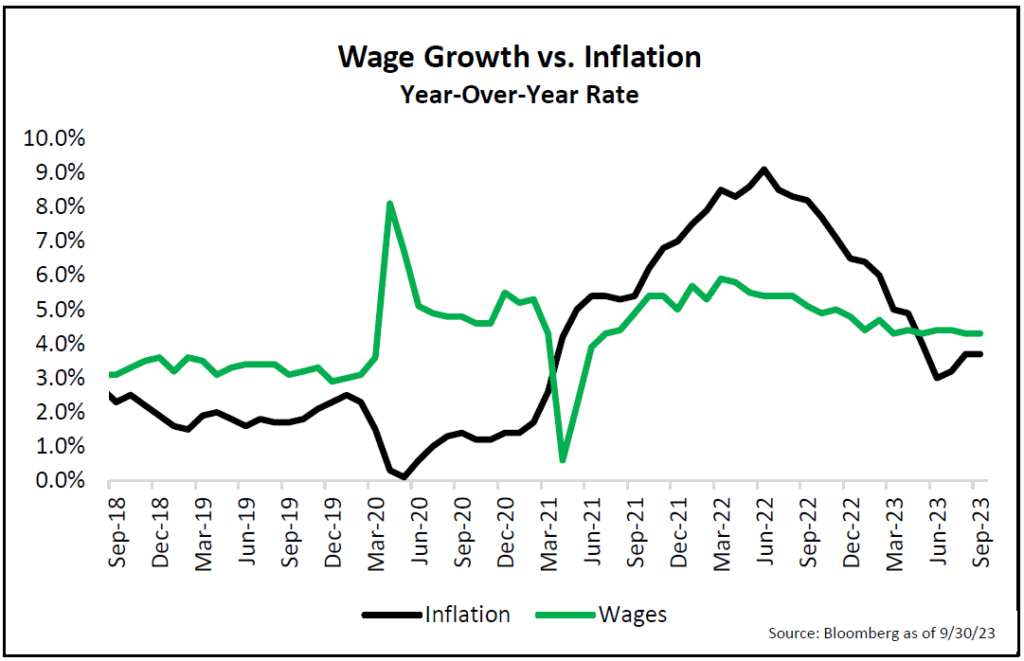

The challenge for the Fed is that their dual objectives (full employment and stable prices) can be in competition with one another. Full employment, like we reached in late 2021, often leads to higher prices (inflation) as wage gains lead to higher buying power. This was compounded by the low interest rates and stimulus money pumped into the economy during the pandemic. Employment was full, but prices were anything but stable.

We expect economic growth to be relatively anemic over the next few quarters, though we do not yet see signs of a significant recession on the horizon. The good news is that assets are attractively priced across many parts of the investment opportunity set. Many parts of the market are meaningfully less expensive than two years ago, particularly more economically sensitive industries as well as investments with significant sensitivity to interest rates. In other words, these investments are priced as if an impending recession or an extended period of elevated interest rates are forgone conclusions. When we take a long-term view toward these assets, we see value today. Short-term high quality fixed income investments yield more than 5%, as do many dividend-paying companies, and smaller US companies trade for just 11x next year’s expected earnings with 25% expected earnings growth (more than double the expected earnings growth of the S&P 500 index at almost half the price).2Bloomberg as of September 30, 2023

Despite these headwinds, the labor market has remained resilient. The unemployment rate is still near a 50-year low at 3.8% and job openings are well-above long-term averages which is a sign that employers are sufficiently confident in the economy to continue to hire. And, very encouragingly, wages are growing at a faster rate than inflation for the first time since early 2021.3Bureau of Labor Statistics as of October 6, 2023 In other words, the average US worker’s paycheck is growing faster than their expenses. This is a great thing.

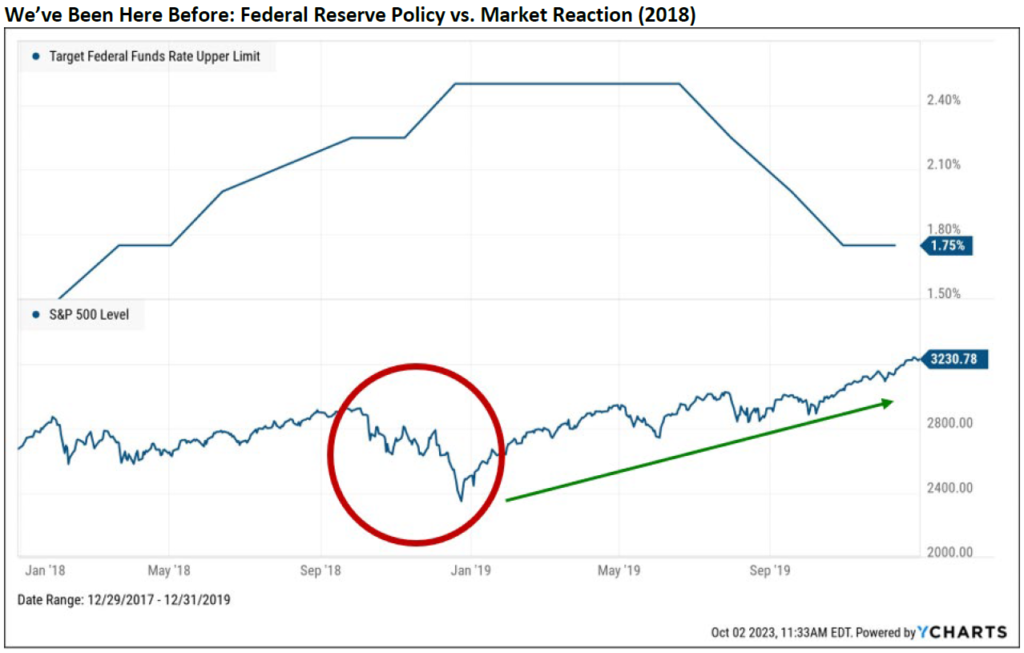

As we navigate the remainder of 2023, it would not be surprising to see continued volatility. For long-term investors, we believe that today is an attractive entry point, and for shorter-term investors (e.g., 1-3 year horizon), short-term US Treasury bonds yield more than 5% for the first time in nearly 15 years.4Bloomberg as of September 30, 2023 And, historically, when the Fed ends its interest rate hiking cycle, markets have performed well in the subsequent few years. Our most recent example, illustrated by the charts on the following page, came at the end of 2018 when the current Federal Reserve Chair, Jerome Powell, communicated to markets that the Fed would shift to a more accommodative monetary policy stance in the face of slowing economic activity. After a 20% decline into Christmas Eve, markets rallied on this announcement. We may be near a similar inflection point in monetary policy, though investors should expect the market to be volatile until more clarity is provided.

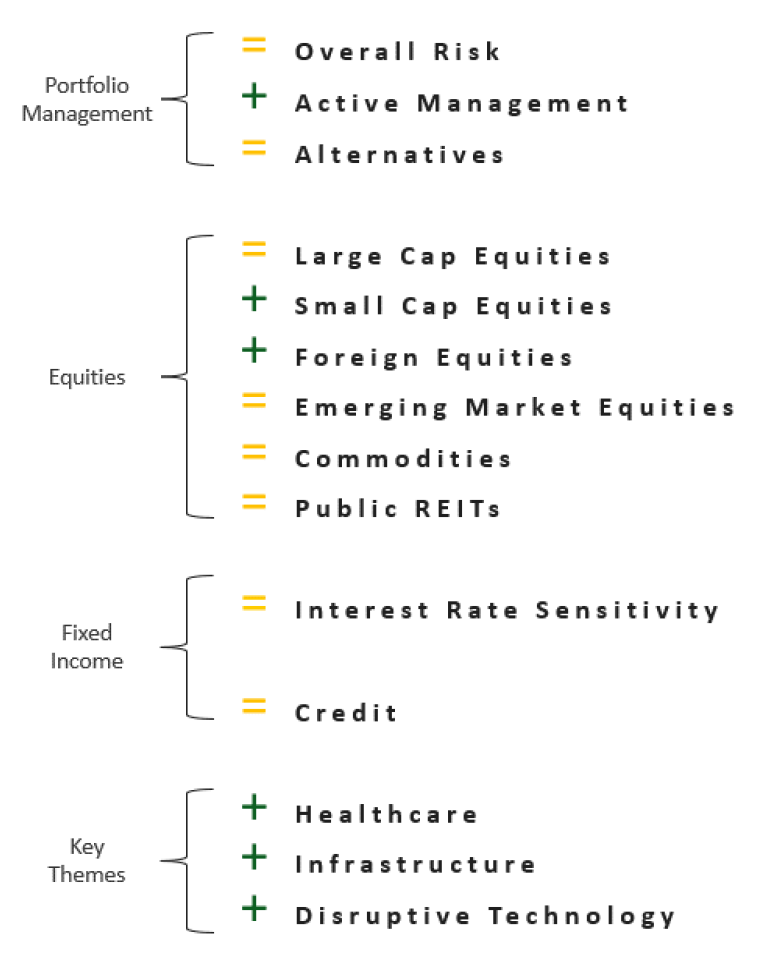

Outlook & Positioning Summary

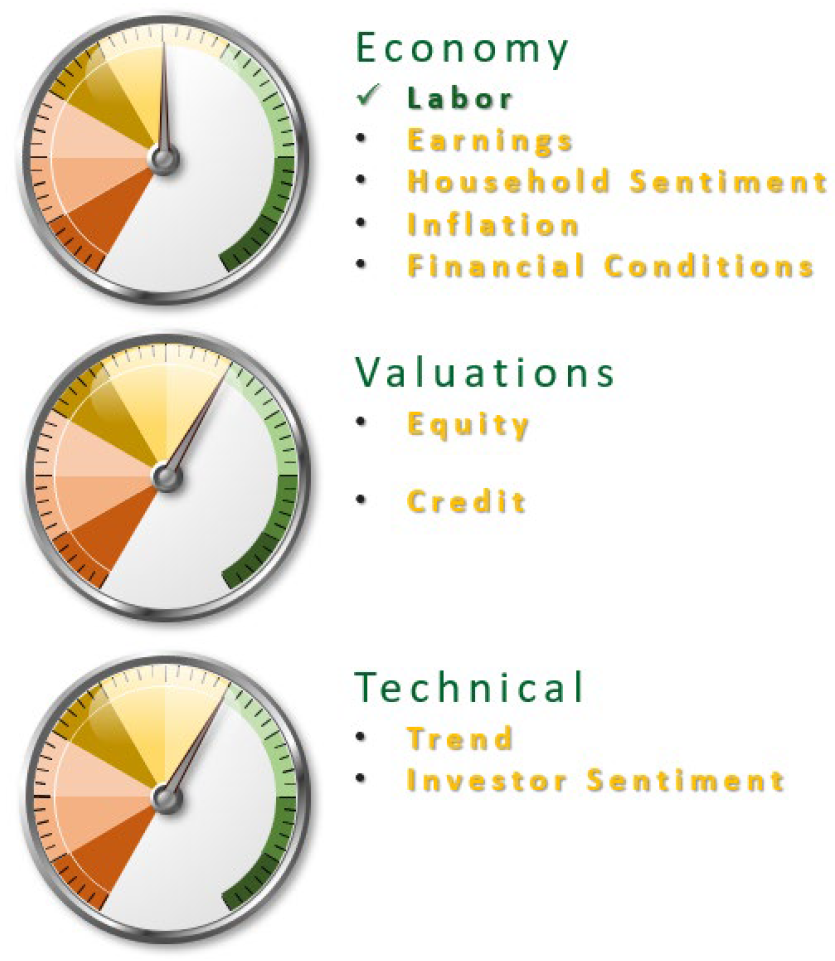

Economy

The US labor market has been a key pillar of strength that helped the US avoid recession in 2023.

Inflation has shown signs of slowing, but higher energy prices, labor strikes, and federal government infrastructure spending have the potential to keep price increases higher for longer, which may require the US Federal Reserve to keep interest rates higher for longer as well.

Valuation

The largest US companies led the market higher in 2023, but we believe that opportunities are still abound in dividend, small, and foreign stocks, as well as within fixed income which offers 5-6% yields today on relatively defensive securities.

Technical

Many asset classes appear to be “oversold” from a short-term perspective, so it wouldn’t be surprising to see a near-term relief rally.

Investor sentiment is more pessimistic again, creating the potential for an attractive entry point.

Positioning

Overall risk versus target is neutral as markets do not appear overly cheap or expensive and economy remains at risk of a mild recession in 2024.

Increasingly looking toward short-term high quality fixed income as well as dividend stocks which may provide defense, liquidity, income, and flexibility in a volatile market environment.

If the Federal Reserve stops raising interest rates, assets such as bonds, dividend stocks, small US companies, infrastructure, and foreign companies all have the potential to perform well.

In the long-term, themes such as innovative healthcare, infrastructure, and technology have the potential to drive portfolio growth and outperform the broad market.

Prices & Interest Rates

| Representative Index | September 2023 | Year-End 2022 |

|---|---|---|

| Crude Oil (US WTI) | $90.79 | $80.26 |

| Gold | $1,848 | $1,819 |

| US Dollar | 106.22 | 103.52 |

| 2 Year Treasury | 5.03% | 4.41% |

| 10 Year Treasury | 4.59% | 3.88% |

| 30 Year Treasury | 4.73% | 3.97% |

Asset Class Returns

| Category | Representative Index | 1 Month | YTD | 2022 | 1 Year | 3 Years | 5 Years |

|---|---|---|---|---|---|---|---|

| US Large Companies | S&P 500 | -4.8% | 13.7% | -18.1% | 21.6% | 10.2% | 9.9% |

| US Large Companies | S&P 500 Equal Weight Index | -5.1% | 1.8% | -11.5% | 13.6% | 11.5% | 8.0% |

| US Dividend Companies | S&P High Yield Dividend Aristocrats | -5.3% | -6.3% | -0.5% | 5.9% | 10.6% | 6.2% |

| US Growth Companies | Russell 3000 Growth | -5.5% | 23.8% | -29.0% | 26.6% | 7.6% | 11.7% |

| US Value Companies | Russell 3000 Value | -3.9% | 1.7% | -8.0% | 14.1% | 11.2% | 6.0% |

| US Small Cap Equity | Russel 2000 | -5.9% | 2.5% | -20.4% | 8.9% | 7.2% | 2.4% |

| Global Equity | MSCI All-Country World | -4.1% | 10.1% | -18.4% | 20.8% | 6.9% | 6.5% |

| Foreign Developed Equity | MSCI EAFE | -3.4% | 7.1% | -14.5% | 25.7% | 5.8% | 3.2% |

| Emerging Market Equity | MSCI Emerging Markets | -2.6% | 1.8% | -20.1% | 11.7% | -1.7% | 0.6% |

| US Fixed Income | Bloomberg Barclays US Agg. Bond | -2.5% | -1.2% | -13.0% | -0.6% | -5.2% | 0.1% |

| US Fixed Income | Bloomberg Barclays Municipal Bond | -2.9% | -1.4% | -8.5% | 2.7% | -2.3% | 11% |

| Global Fixed Income | Bloomberg Barclays Global Agg. Bond | -2.9% | -2.2% | -16.3% | 2.2% | -6.9% | -1.6% |

References

- 1JP Morgan Guide to the Markets as of September 30, 2023

- 2Bloomberg as of September 30, 2023

- 3Bureau of Labor Statistics as of October 6, 2023

- 4Bloomberg as of September 30, 2023