There is a potential fight brewing in this country, but despite the title of this note, not one that will involve any physical violence (hopefully). The US debt ceiling needs to be raised in order for our country to meet its ongoing financial obligations. While this could be accomplished quite easily by Congressional approval, nothing related to politics is easy these days. In fact, the quote below illustrates just how tenuous the situation could turn out to be:

“The debt ceiling is no doubt going to be a knife fight,”1Source: GOP ‘won’t budge’ on spending-cut demands in debt-ceiling fight: Comer | Fortune

~Representative Tony Gonzales

What is the debt ceiling?

The debt ceiling is a legislative limit on the amount of debt that the United States Treasury can incur. This limit is set by Congress and has been in place since 1917. The debt ceiling is separate from the federal budget and is intended to ensure that the government does not spend more money than it can afford to pay back.

Secretary Janet Yellen, who leads the Treasury, informed Congress on January 19 that the debt limit had been reached and that “extraordinary measures” would be taken to avoid defaulting on payments. These measures amount to accounting maneuvers used to avoid default. Secretary Yellen indicated that it is difficult to estimate exactly when the Treasury would run out of money, but that they should have sufficient liquidity until at least June. Others have suggested that the inflow of revenue from tax returns in April could extend the timeframe until July or August. Regardless of the exact date, Secretary Yellen urged Congress to act quickly to “protect the full faith and credit of the United States.”2Source: Debt-Limit-Letter-to-Congress-20230119-McCarthy.pdf (treasury.gov)

Has this happened before?

The debt ceiling has been raised more than 100 times since World War II; most recently in December of 2021. In addition, extraordinary measures have been used six times since 2011 to keep the government going. As a result, negotiating the debt ceiling is supposed to be a business-as-usual political event. In recent history, however, the debt ceiling has become a source of contentious debate and political maneuvering.3Source: Q&A: Everything You Should Know About the Debt Ceiling | Committee for a Responsible Federal Budget (crfb.org)

Why the debate?

The main issue at stake is the need for the government to borrow money to finance its operations, versus the concerns of some lawmakers and citizens that increasing the debt limit is fiscally irresponsible and could lead to inflation or other economic problems. Unfortunately, in our current political environment it seems any opportunity to cast the other side as the problem is one worth battling over. Worse yet, the political partisanship appears to be spilling over into the general public.

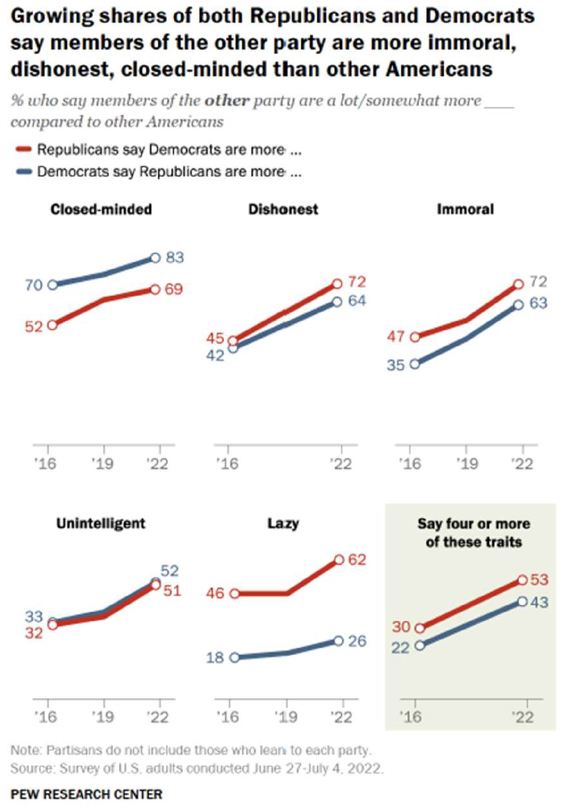

Consider the Pew Research Center results at right, illustrating what members of each party think of the other. Polling showed a significant jump in the number of people that think members of the other party are immoral, dishonest, close-minded, unintelligent, and lazy. In another poll, Pew found that 62 percent of Republicans and 54 percent of Democrats have a very unfavorable view of the other (up from 21 percent and 17 percent in 1994, respectively).4Source: Partisan Hostility Grows Amid Signs of Frustration With Two-Party System | Pew Research Center

In what is essentially a two-party system, those types of results explain a lot. If you believe that the other party is going to ruin the country, you’re more likely to vote along party lines without even considering the issues or candidates. Those who hold office have to consider the polarizing environment too, as working with the other side to reach an agreement could be construed as being soft on the opposition. We believe this is the politically charged environment in which we find ourselves as the run-up to the 2024 Presidential election heats up and that could make negotiations even more strained than normal.

What happens if an agreement isn’t reached?

If the US Treasury is unable to issue new debt to pay its bills, it will default, at least temporarily, on many of its obligations. While it is difficult to handicap whether the US will technically default this summer, we anticipate that the event will roil global markets should it occur.

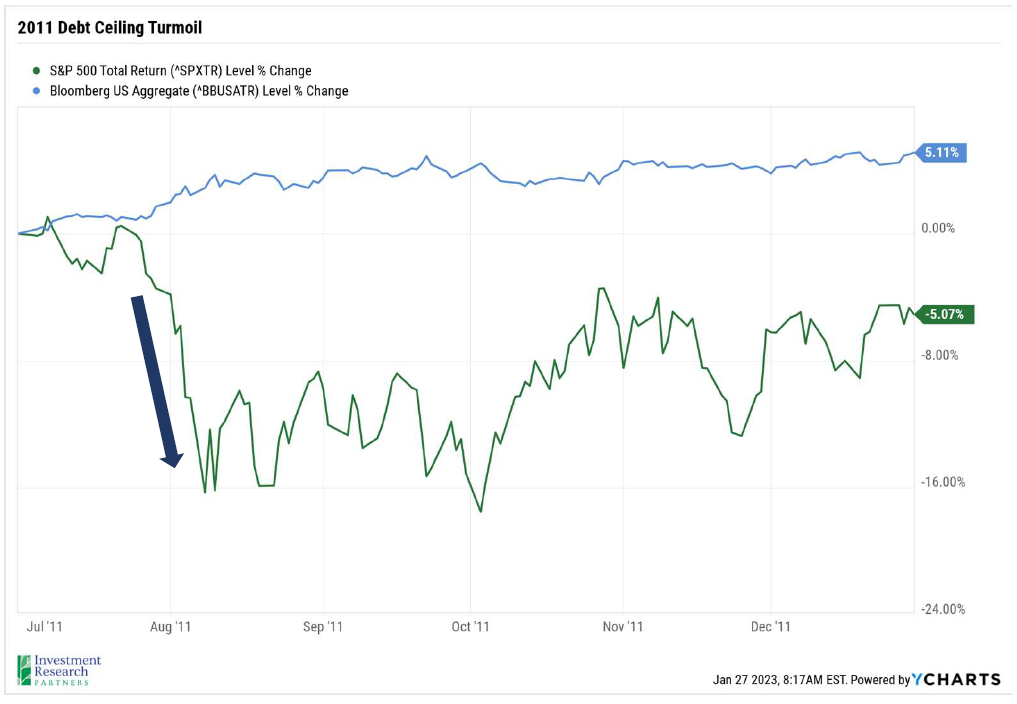

The most recent analogue to our current situation played out in the summer of 2011 when the highly politicized debate brought the government within hours of technically defaulting on its debt. While a last-minute agreement was reached after tense negotiations, the prolonged fight resulted in Standard & Poor’s downgrading the federal government’s debt, a move that rattled global risk assets. The S&P 500 index subsequently fell more than 17 percent before rallying back somewhat toward the end of the year (see chart at right).

Counterintuitively, US Treasury bonds, which were downgraded because of the event, continued to act as a safe haven for investors concerned about volatility.5Source: 2011 United States debt-ceiling crisis – Wikipedia

What comes next?

The potential outcomes of the debt ceiling debate vary significantly. On the one hand, this could end up being a non-event from the market’s perspective – politicians arguing over the issue in an effort to win points with voters but ultimately choosing to reach an agreement rather than risk a sovereign default. On the other hand, given how polarizing politics are at the moment, it is conceivable that political brinkmanship wins out and pushes the country into default. What we can say with somewhat more certainty is that we fully anticipate this topic continuing to gain narrative strength in both financial and political media as summer approaches.

Rather than attempting to predict how this issue will ultimately play out, we intend to measure our response by monitoring how the situation evolves in the weeks to come. Along with the battle against inflation, the fear of recession, the war in Ukraine, tensions with China, amongst other concerns; this is one more issue that has the potential to shape the investment landscape in 2023. As always, please reach out if you would like to schedule a time to review your specific situation.

References

- 1Source: GOP ‘won’t budge’ on spending-cut demands in debt-ceiling fight: Comer | Fortune

- 2Source: Debt-Limit-Letter-to-Congress-20230119-McCarthy.pdf (treasury.gov)

- 3Source: Q&A: Everything You Should Know About the Debt Ceiling | Committee for a Responsible Federal Budget (crfb.org)

- 4Source: Partisan Hostility Grows Amid Signs of Frustration With Two-Party System | Pew Research Center

- 5Source: 2011 United States debt-ceiling crisis – Wikipedia